By Oguzu Lee

Tax Justice Advocate

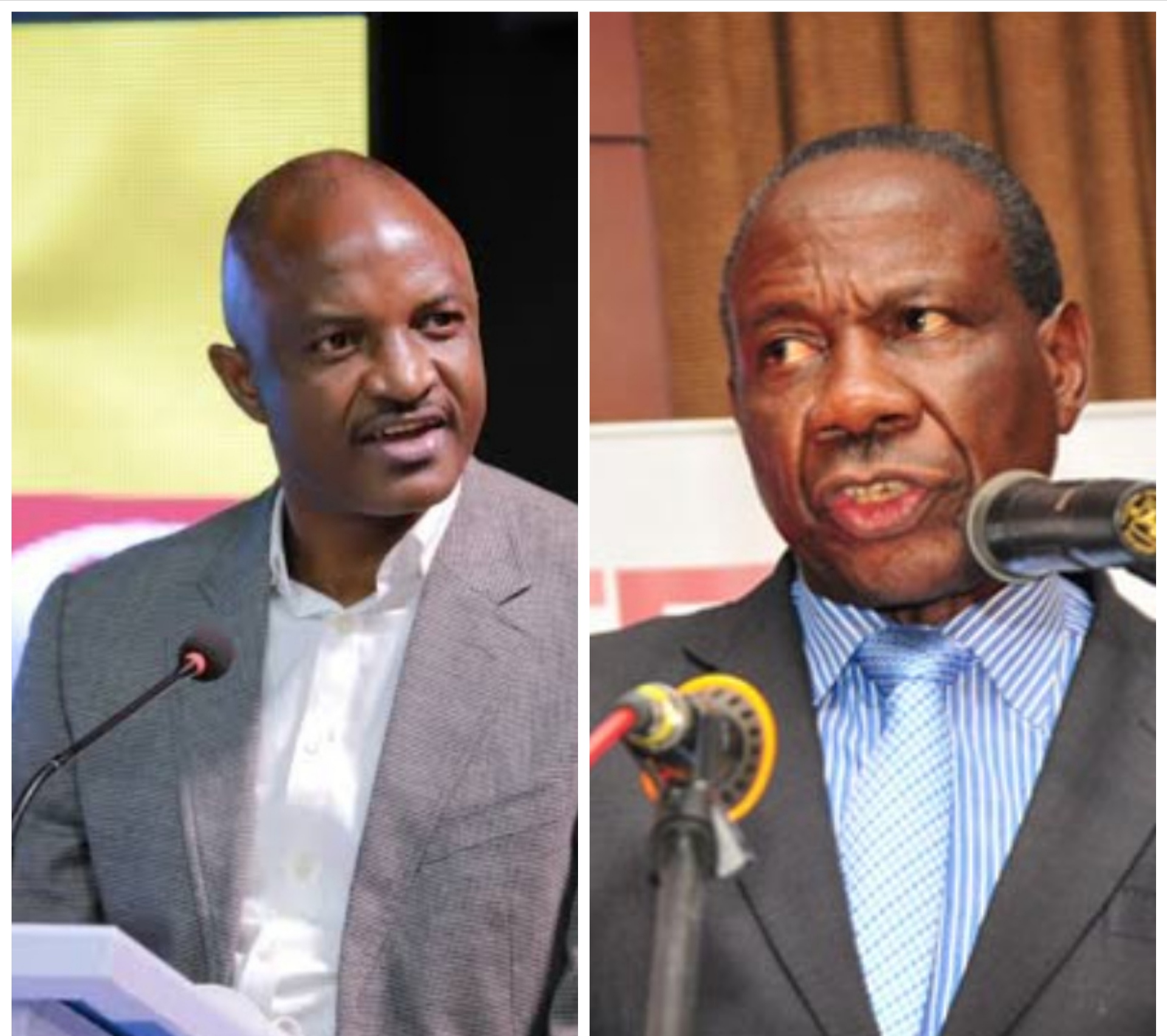

Uganda’s belligerent ruling party’s unapologetic Finance Minister Matia Kasaija and celebrated economist also Finance Ministry Permanent Secretary Ramadhan Ggoobi are not only a threat to domestic resource mobilization efforts but the combination of their reigns aided by NRM’s numerical strength in parliament could erode the nation’s tax base. According to Thabo Mbeki Commission, Africa loses $50bn each year to tax avoidance and illicit financial flows. Locally, Civil Society estimates between 2006 and 2015, Uganda lost estimated $4.9 and $1.7bn billion to import and export misinvoicing. According to East African Tax and Governance Network, Uganda in 6 years lost $3 billion in tax incentives to multinationals which exemptions according to URA equated to one quarter of the budget for FY2020/21.

From the duo’s policies symbolised by fiscal deficit and growing national debt, many are getting to ackwowledge that text book economics is indeed different from real life economics. The current suffering of the Ugandans without any intervention from the duo attest to such reality.

For many who watched and looked upto Dr. Ggoobi, Uganda’s celebrated Economist articulate economic policies on TV, it was a dawn of hope when he got appointed. There was hope that he would be part of their journey to middle income status by expanding their earnings and Uganda’s domestic resource envelop without hurting the ordinary people.

Whereas the Minister and his economist PS have publicly been able to recognize locals as the engine of economic growth, policies emanating from their kitchen are not in tandem with the proclamations.

Last year, on their watch as frontline drivers of economic policy and development, government delivered one of the most expensive yet unqualified tax incentives and exemptions to East African Crude Oil Pipeline (EACOP), a $10bn oil pipeline project which seeks to open one of the most sensitive tourism ecosystems, Marchision Falls National Park to oil pollution. EACOP law which insubordinates many other laws such as Public Fnance Management Act, PPDA Act, UCC Act and tax laws will go down in history as one of the biggest, immoral tax avoidance structures ever created by parliament on their watch with the help of NRM’s numerical strength in the August House.

Before the dust could settle on scams like Lubowa project and the nation fully recovers from past surrender of tax rights to entities like Bidco making billions of profit and failed Bujagali power project that was sold as cure for the high power tariff, they extended another 10 year tax holiday to Vinci without parliamentary approval in a coffee deal executed without cost-benefit analysis, thus helping to entrench uncompetitive practices in the economy.

Who doesnt know the dangers posed by monopoly in a free market economy like ours? How many jobs will be lost if coffee processors across the country shutdown; compare this with supposedly 250 jobs be created by Vinci? Will monopoly really increase production as argued by the duo? Is what the country needs not a quality benchmark for all to comply with?

It’s not only sickening for special purpose vehicles like EACOP and Vinci to enjoy unqualified tax holidays or be exempt from corporate tax, VAT, import duties, withholding fees and other levies. It also means that when ‘profits’ from such ventures are successfully shifted out and tax revenues from those profits disappear from our ledger, our healthcare, schools, water sanitation and other public goods will be left without funding, women and men, boys and girls without pathways to a brighter future.

Nobody really knows what the full extend of the loss arising from these tax holidays and exemptions will be in light of OECD led global tax agreement which seeks to set the global corporate tax rate at 15% which is below our national average. To imagine these people are not aware of our low tax-to GDP ratio, perennially low per capita expenditure on health and education is hard. At least our inability to realise structural changes overtime compared to neighbours due to inadequate resources should have reminded drivers of our economy of dangers of an unfair wealth distribution and taxation regime.

At the height of skyrocketing commodity prices where there is no one to turn to, wanaichi had hoped the Minister with help of his decorated Economist PS would summon their prouness and party’s numerical strength to push through policies including redirection of the Consolidated Fund to cushion and to help the poor navigate adverse effects of the skyrocketing prices but the duo are shouting: “subsidies won’t work for the poor.”

These comrades need to be reminded that supply side subsidies especially to producers of essential goods would result into more goods and services being produced. Surplus production would increase demand and lower prices which would inturn cushion the hurting poor Ugandans from skyrocketing prices. Increased demand and consumption would translate into more tax revenues for the government to deliver public goods and services.

In the current situation, as displayed our neighborhoods, subsidies are actually helping the poor better than some of our unqualified tax holidays. Research shows after sucessfully exploiting such tax holidays and shifting profits, many beneficiary multinationals tend to exit such markets without any benefits accruing to the economy.

It’s high time we took stock of our tax incentives and assessed their impact on the poor and the economy to qualify any further decisions on additional tax incentives especially in favor of foreign investors. It’s even worse when such holidays are extended to companies domiciled in tax havens with whom we already Double Taxation Agreements.

We must pray for a time in our country’s history when text book economics can work in real life for the benefit of ordinary people.

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article