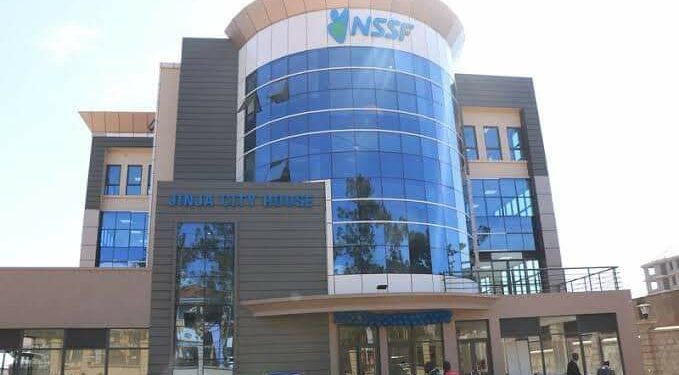

Finally, Ugandans who save their money with the National Social Security Fund (NSSF) can get at least 20% of their savings and interest as long as they are 45 years old and above ad havs saved for 10 years instead of waiting to access the money at the age of 55. I had argued in these pages that people should qualify for 50% not just 20% but where I come from, they say first get what you can as you bargain for more.

Many people who get lumpsum payments usually lose it in a short time either in wrong investments or simply fail to manage the windfall. It may sound weird but many of those who will get the money need to be sensitized to invest it and NSSF should regularly organize such seminars. Of course the hardest people to advise are those who have just received a good sum of money.

The main reason people lose money is because they aren’t used to it or they invest in stuff they have no idea of. You will hardly find a business that isn’t profitable on paper — all business plans show profitability at one stage.

However, many of the people who qualify to get this money are still somewhere employed and they could go slow in starting businesses. In Uganda, there is an overpromotion of self-employment as the only pathway to untold wealth. This narrative is misleading. There are employed Ugandans whose income is much more than what many businessowners will ever make in a lifetime.

Most self-employed Ugandans are hustlers — struggling to make ends meet on a daily basis and are usually one illness away from total financial apocalypse. They work longer hours without any holidays. Actually, for them, if they don’t work, they won’t eat.

Raising capital is expensive and difficult. Taxes, rent, and the cost of doing business take way the little that they would have saved. Getting customers and contracts is difficult and payments sometimes take time. It may sound glamorous to mention yourself as a CEO, director or self-employed but many times what matters is what one takes home.

So if you are 45 and qualify for the 20%, you don’t necessarily need to do anything with this money. You don’t have to withdraw it so that you start a business which you may not even have time to supervise in a week because of your job elsewhere. If you don’t have a business already, it takes on average five years to master it— establishing useful supplier contacts, understanding the customers, clients getting to know you and the tricks involved in running the enterprise. Many of the money used as start up capital in many cases is lost. Businesses in the earlier stages of their establishment largely survive on the founder’s tenacity. That is why many businesses that are started in Uganda don’t celebrate their fifth birthday.

I know many people who have lost money by trying to start up side businesses or side hustles as we call them.

So the beauty of the 20% midterm access to NSSF money is that you can get it any time as long as you are 45 years old and above and have saved with the fund for 10 years. There is no timeframe when you can access it. So if your idea is to start a business, first “chill” touching the NSSF money. Raise money through other means such as saving a certain percentage of your salary and start the business. Once the business is established and you have learned the intricacies of running it, you can withdraw the NSSF money and invest it in the business. That way you have to an extent firewalled yourself against losing this lumpsum payment.

And where you invest it should be more than what NSSF is giving you as interest. Currently, NSSF is giving 12.5% annually as interest. So if you are withdrawing the money to invest it, the business should be able to give you more than 12.5% a year as net profit otherwise it makes no business sense to hustle and earn less than what you would earn from NSSF while doing nothing. The biggest problem with NSSF was inability to withdraw any money until age 55. Now that this is out of the way, NSSF earnings could be your ‘side hustle’ if you are above 45 years old.

The writer is a communication and visibility consultant. djjuuko@gmail.com

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com