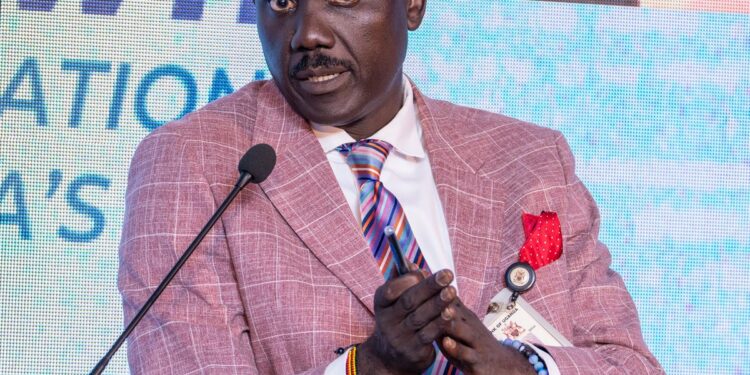

At the 6th Annual Financial Technology Service Providers Association (FITSPA) Fintech Conference, the Executive Director, of National Payments Bank of Uganda officials Dr Twinemanzi Tumubweinee highlighted the need for cooperation, managing Artificial Intelligence (AI) impacts, and proactive cybersecurity measures to ensure the sustainable growth of Uganda’s digital economy.

In a session focused on the future of fintech, Dr Tumubweinee emphasized that the path to success lies in balancing competition with collaboration among industry players. “For FinTechs to thrive, they must stop viewing each other solely as competitors and explore synergies that benefit the entire ecosystem,” he said

He noted that by pooling resources and aligning goals, FinTech companies in Uganda can create a more robust and resilient financial sector that will drive Uganda’s digital transformation forward.

“Working together and realizing that what you do in one place impacts another is critical,” he stated, underscoring the interconnectedness of fintech innovations and regulations.

In his address, he made it clear that for Uganda to fully embrace a digital economy, both fintechs and regulatory agencies must also adopt a cooperative approach. “We need to subservient our ideas and goals to a bigger objective. If a digital economy is what we are aiming for, every regulator must draw a line, dotted or solid, from their current actions to that desired future state,” he added.

The Complex Role of Regulators in a Digital Economy

Dr Tumubweinee also spoke on the complexities of regulating new technologies, particularly artificial intelligence (AI). “I do not believe we should regulate AI,” he remarked, offering a perspective that highlighted the dynamic and uncontrollable nature of technological evolution. “Any regulator that attempts to regulate technology has lost the battle before it even begins because technology will evolve whether or not you are part of it.”

Rather than trying to regulate AI directly, he urged regulators to focus on managing its impact, such as its effects on jobs and other sectors like construction and finance. He used the example of ChatGPT to illustrate how rapidly AI could change the financial industry. “The question is, what are the potential negatives? What are the risks associated with AI? That is where we should focus as regulators, not on AI itself,” he noted.

“Regulation should follow innovation. Regulators tend to be risk averse but “no one ever progressed by being orderly, for something new to come up, something old must be destroyed.” Regulators should be open-minded, they must be friends” he said.

Another crucial area of discussion was cybersecurity, a concern that has become increasingly urgent in Uganda as FinTechs continue to proliferate. He described cybersecurity as a “chain” only as strong as the weakest link often the human factor. “Cybersecurity tools are only as good as the people and entities that use them,” he said, pointing out that user negligence is often the biggest challenge in combating cyber threats.

“Regulators and technology providers can only do so much. The focus should be on the people who interact with these technologies. They should be the first line of defence against fraud. Everyone is an enemy until they have been proven,” he stressed.

Collaboration, Not Competition, for Fintech Success

Dr Tumubweinee encouraged FinTech companies to focus on collaboration rather than competition, especially in a growing market like Uganda’s. He acknowledged that competition is necessary but cautioned against the isolationist mentality prevalent among some businesses. “Stop looking at each other as competitors. Even as you compete, some synergies can benefit the entire industry if you cooperate at the same time,” he advised.

In particular, he urged established FinTech companies to prepare for disruptions in their traditional sources of income, citing innovation as the key to survival in an ever-changing industry.

“Be ready to lose your traditional income streams. Plan for their replacement now, so when disruption comes, you’re already prepared for it,” he recommended. He also pointed out that in the fintech world, “a few kids in some garage somewhere” could easily disrupt established companies. “Instead of waiting to be disrupted, disrupt yourself. We all need to realize that the future we build today depends on the collective actions we take now,” he said.

Meanwhile, as per the reported survey conducted this year, the future of fintech in Uganda seems bright since everyday numbers are increasing but it will require a concerted effort from both regulators and innovators to ensure sustainable growth and security in the digital economy.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com