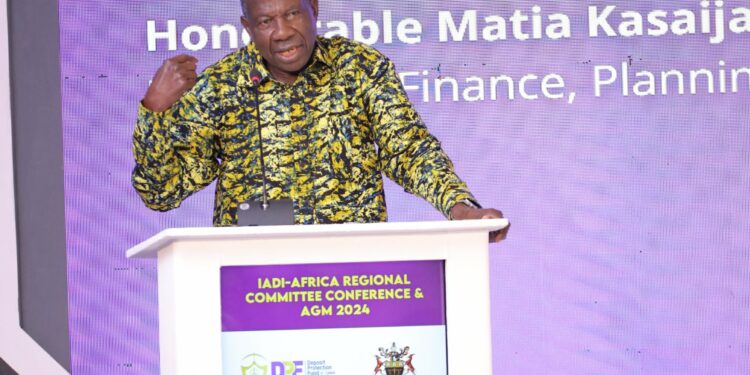

The Minister of Finance, Planning and Economic Development Hon. Matia Kasaija has reassured depositors across Uganda that their funds are well-protected, citing the robust measures in place under the Deposit Protection Fund (DPF).

Speaking at the Conference and Annual General Meeting of the Africa Regional Committee of the International Association of Deposit Insurers (IADI), held at the Lake Victoria Serena Golf Resort, Minister Kasaija highlighted that depositors holding accounts with various financial institutions should be confident, as their deposits are insured against risks to the tune of 90%.

The conference, themed “Financial Stability & Protecting Deposits in a Dynamic Financial Ecosystem,” brought together key stakeholders from across the continent to discuss the evolving financial landscape and the importance of safeguarding depositor funds.

Minister Kasaija reported a significant growth in the assets of the Deposit Protection Fund, which have surged to over 1.4 trillion shillings from a modest 200 million shillings in 2018. This substantial increase, he noted, underscores the government’s commitment to financial stability and depositor protection. The DPF, which covers 25 regulated financial institutions, including all commercial banks and Tier II institutions, plays a crucial role in maintaining confidence in Uganda’s financial system.

“These institutions are mandated by law to contribute to the Fund,” Kasaija explained. “In case of a failure, the DPF is responsible for compensating depositors up to 10 million shillings of their deposits.”

Kasaija emphasized that the main objective of the DPF extends beyond just compensating depositors of affected banks. “It is about providing depositors, investors, and the general population with the confidence that whatever happens, their deposits are safe,” he stated.

He further highlighted the importance of financial stability and robust deposit insurance systems, adding, “Ensuring reliability of the sources of funds and the frugal use of such funds are key tenets necessary for ensuring financial stability.”

Protection for Both Small and Large Depositors

The majority of savers in Uganda, as in many other African countries, have deposits of less than 10 million shillings – the segment primarily targeted by the DPF. However, Minister Kasaija reassured that larger depositors are also protected through various mechanisms facilitated by the Bank of Uganda.

Michael Atingi-Ego, the Acting Governor of the Bank of Uganda, elaborated on these protections during his address to the delegates. “We recognize that the protection of depositors extends beyond the insurance threshold,” he said. “For larger deposits, we have mechanisms in place – from purchase and assumption transactions to assisted mergers – to safeguard funds and maintain the integrity of our financial system.”

Atingi-Ego emphasized the growing importance of deposit protection funds, particularly in light of the rapidly evolving financial and economic environment. “As we look to the future, we face new challenges: the rapid evolution of financial technology, the increasing interconnectedness of global markets, and the ever-present threat of economic shocks require us to be ever-vigilant and adaptive,” he noted.

The conference saw the participation of heads of deposit protection funds and central bank governors from across Africa, reflecting the continent’s collective effort to strengthen financial stability.

The Africa Regional Committee (ARC) of the IADI, which hosted the event, plays a pivotal role in this endeavor, facilitating the exchange of information and ideas on deposit insurance across the region.

The CEO of the Deposit Protection Fund and Chairperson of the IADI-ARC Dr. Julia Claire Olima Oyet welcomed the delegates, noting the significance of the gathering. “It is indeed an honor for me to warmly welcome you to this year’s gathering of deposit insurance jurisdictions from across Africa,” he said.

Addressing Minister Kasaija directly, he added, “Hon. Minister, five years ago in 2019, you graciously joined us for a similar gathering. I am, therefore, delighted and wish to appreciate you for accepting, yet again, to honour this occasion with your presence as our Chief Guest.”

He further highlighted the growth of the Africa Regional Committee, which now includes fourteen member countries, with associate members mostly comprising central banks. “This year, we are pleased to receive delegates from potential member countries including Ethiopia, Eswatini, Burundi, and Mozambique, among others,” he remarked, signaling the expanding influence and importance of deposit protection across the continent.

As the financial landscape continues to evolve, the conference underscored the need for continued vigilance and cooperation among African nations to ensure the safety and stability of their financial systems.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com