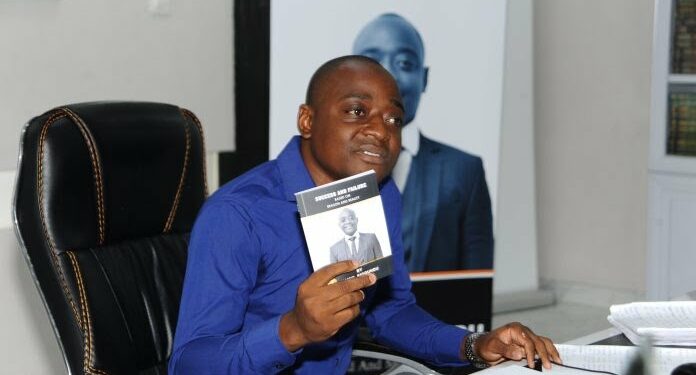

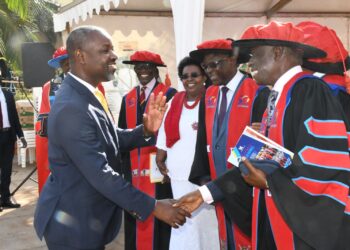

Uganda’s prominent businessman Hamis Kiggundu alias Ham has advised upcoming Ugandan entrepreneurs not to fear using banks for growth and starting up businesses.

He, however, cautioned them not to ever rely on such loans as a long-term sustainable muscle of their business expansion because banks will always feast on their businesses since they are driven by the profit motive.

“With banks and financiers, it is not about trust or emotions, it is about making business sense. Banks are equally driven by a profit motive just like private companies. If you think your bankers are your friends, then you’re mistaken; those are your business partners. That is why they foreclose immediately as soon as you make a default on your payments. In my opinion, banks are a good source of start-up and expansion capital but never for long-term sustainable progress,” he said in one of the interviews conducted by Billionaires Africa a few months ago.

In the same interview, he advised that one can only reasonably benefit from banks if they hold relatively equal or reasonable bargaining positions to negotiate fair interest rates and fair-trading terms.

Ham continued to reveal that because of the unfair lending interest rates, banks in Uganda and in most African countries appear as if they are fighting business growth.

“In Uganda and most African countries, interest rates stand at as high as 25-30 per cent. There are very narrow chances of small businesses succeeding and enjoying long-term sustainability with these kinds of rates. With time, I have mastered the art of growing my operational capital internally thus outgrowing the need for exploitative financing from banks for now,” he said.

According to Ham, the majority of businesses standing in Uganda are a result of the existence of banks, however also the majority of the collapsed businesses in Uganda are as a result of banks, therefore banks can either create or destroy any business.

Ham also cautioned Ugandan entrepreneurs to always critically reason and analyze their business situations before taking a decision of acquiring a loan from any bank.

“If you don’t need a loan stay away from it, some banks will exploit your business and collapse. What you must know is that these so-called banking investors invest less capital and later the business accumulates a lot of money. Where does that money come from? That is why all the banks through their umbrella Uganda Bankers Association waged a war against me,” he said in one of the interviews.

Meanwhile, the banking sector in Uganda dominates the financial system and accounts for about 70 per cent of the total assets in the financial system.

A stable banking sector plays a crucial role in supporting economic activity, promoting economic growth and ensuring financial stability. While an unstable sector with high rates interest rates may not favour business growth.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com