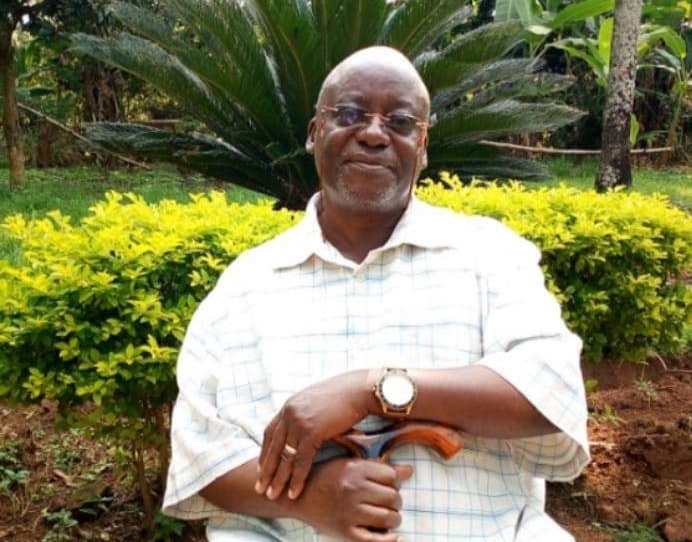

The Insurance Regulatory Authority (IRA) Chief Executive Officer Ibrahim Kaddunabbi Lubega has asked Ugandans to embrace the idea of risk management through insurance as a top priority.

Mr Kaddunabbi who was the chief guest at the 3rd Annual Conference of the Insurance Brokers Association of Uganda (IBAU) held at Hotel Protea on Thursday, said that the recent Covid-19 pandemic should be a clear example to every living Ugandan that risk management is now a priority in business or person’s life.

Since May last year, research has shown that business owners who had their businesses insured suffered less than those who did not have any insurance. Covid-19 was a great risk since it did not leave any business standing. However, those who had insured at least filed claims and were given a start up but those who did not, most of their businesses collapsed.

To avoid what happened last year, Mr. Kaddunabbi advised that since it may take longer for the entire world to go back to normal, the only way someone can survive in the time when the pandemic is mutating is to embrace risk management at a maximum level.

“Ladies and gentlemen, this is the time for us to take risk management as our priority and help business entrepreneurs in planning and protecting their businesses from catastrophic loss exposures. Covid-19 should be a trigger for a fundamental reset. The disease has taught us that our planet and the prosperity of our societies are even more vulnerable to such risks than we thought. Today is a good opportunity for further reflection, exchanges, and sharpening of our plans to contribute to an inclusive and sustainable recovery as we re-align our business operations to the new Normal,” Mr Kaddunabbi noted.

He further emphasized that it is now crucial that insurance brokers learn how to effectively navigate the impact of political risks, legal, regulatory and policy developments on their short and long-term strategies.

“The role of our professional brokers cannot be underestimated in our sector. Insurance brokers work on behalf of the client to provide professional advice to the client’s best interest. An insurance broker will help the client identify which risks they face and then tap into their extensive relationships with insurers to obtain several options best suited for your business needs and budget,” he asserted.

On the role of IRA, Mr. Kaddunabbi said that their commitment is to see that there is excellence in the insurance sector and this why last month they launched the Client Service Charter which will provide timely services to all stakeholders with a set of written promises and clear standards.

“Whenever and wherever you deal with us. We hope as Insurance brokers you will also adhere to your set obligations. The writing is on the wall that ‘Time Matters’ .”

Ramathan Ggoobi an economist and Makerere University Business School don who was the keynote speaker advised insurance stakeholders to concentrate on ensuring continuity of services since there is a need for continuous regulatory adjustments to support business continuity plans.

Also to manage solvency and liquidity risks, Mr Ggoobi said, “Accurate and timely stress tests to monitor market, underwriting and liquidity risks. Need for additional data from insurance companies related to risks.”

He also advised insurance companies to provide support to policyholders that have been adversely affected by the Covid-19, through proper guidance on the applicability of various coverages to Covid-19 related losses.

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article