At the beginning of 2020, businesses and economies globally were hit by Covid-19 pandemic which made most companies shut down or reduce their cost of production.

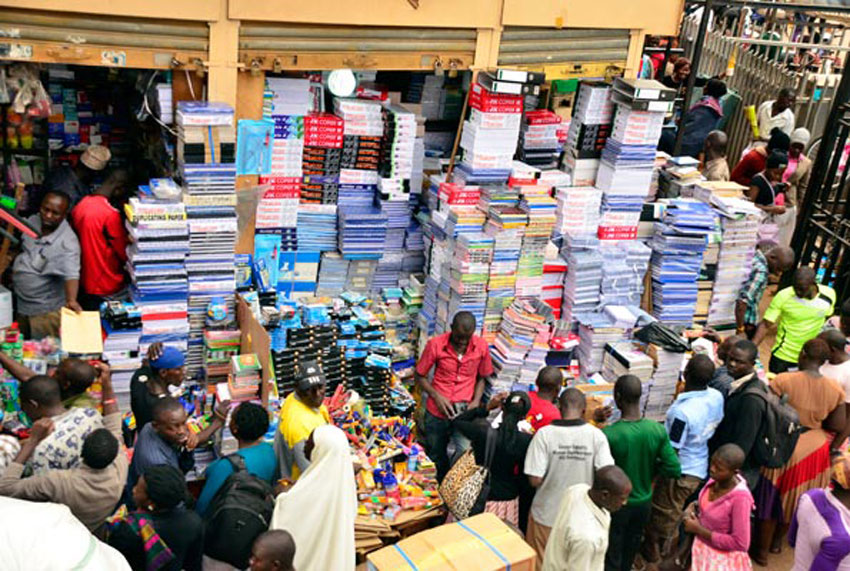

In Uganda, the informal sector which comprised largely of micro and small enterprises (SMEs) makes up 50 per cent of the economy and employs 98 per cent of the working-age labour force. This sector has been one of the hardest hit, with people engaged in trading, services and hospitality most affected by Covid-19 restrictions.

The direct impact of Covid-19 has caused the loss of jobs and incomes, with worst cases of SME owners experiencing incomes falling below zero. This resulted into the discontinuation of their business activities.

According to a study dubbed Socioeconomic impact of Covid-19 in Uganda by the Development Initiative, although the fiscal policy is playing an important role in mitigating the pandemic’s impact and promoting quick recovery, the negative impact of Covid-19 on Uganda’s economic output, domestic revenue mobilisation and public financing in 2020 and beyond is projected to be huge.

Shortfalls in revenue collection could significantly exceed projections if the spread of Covid-19 necessitates the prolonged implementation of restrictive control measures.

According to the warning by the ministry of finance, revenue collection could register a further shortfall of Shs 82.4 billion shillings in this last quarter of 2020 and another Shs 187.6 billion in the coming financial year, even if the virus is quickly contained.

This is because the informal sector which was contributing alot to the revenue collections are also struggling thus making it hard for them to pay taxes yet the economy needs revenues to boost other sectors.

In an interview, the Executive Director of Private Sector Foundation Uganda (PSFU), Gideon Badagawa said that if the government is really interested in building again the business muscles of Ugandans whose businesses shrunk due to Covid-19, collecting taxes would have not been too quick.

“Government must first do a survey and really find out whether Ugandans in the business currently are ready to pay taxes. Tourism has been one of the biggest foreign exchange earner and one of the biggest taxpayers but the question is when you look at hotels have they been making profits in the last six months? airports have just been opened. The government knows very well that we pay taxes depending on the profits we accumulate,”Badagawa said.

He added that currently, many businesses have been making only loses meaning their performing capital is even reducing due to losses and which will make it even worse when they are taxed because they will be resorting to closing businesses.

“Government must ask themselves how the people they want to tax have been fairing in the last five to six month? Once they beginning answering such questions they will get information whether or not they now need to begin picking taxes,” he said.

However, Badagawa also cautioned business owners to start filing their tax returns to ensure that the government sees the health of their businesses.

“Because if the taxman comes and asks for tax, show them that in the last three or six months this is what has been happening, show them that even people can not pay my rent. If you a bank show them that people can not pay interest on their loans. When you file these returns you give information to the government to be able to make a decision but when you hide away then government starts to think that you are making money but you just want to hide away from taxes.”

In order for the two sides to remain in the simultaneous equation, the government must launch a survey to understand the current business environment and the working of the private sector. At the same time the private sector must also demonstrate that they have been in dire situation.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com