As the world commemorated the 2020 International Day of Family Remittances (IDFR) on June 16 in this game changing year, it is important to draw attention to the millions of migrant workers globally who play a vital role in global economies says the UN.

Countries around the world went to battle with a novel virus that emerged late in 2019 in order to save millions of lives, enforcing strict stay-at-home measures to curb the virus’s spread. As a result economies globally came to a complete or a near-complete standstill.

This will have directly impacted the more than 200 million migrant workers who support their 800 million family members back in their home countries (United Nations, 2020).

In April, the World Bank predicted the sharpest decline of remittances in recent history. Global remittances were projected to decline sharply by about 20 percent in 2020 due to the economic crisis induced by the COVID-19 pandemic and shutdown. Remittance flows to Sub-Saharan Africa are expected to decline by 23.1 percent to reach $37 billion in 2020, while a recovery of 4 percent is expected in 2021.

For those families depending on remittances to fund their basic living costs, the risk of falling below the poverty line has increased substantially.

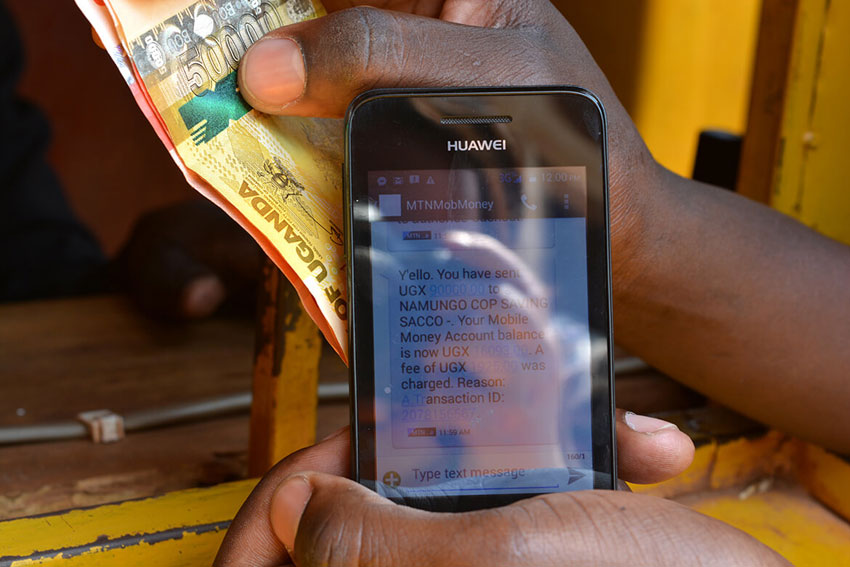

Cashless transaction

This illustrates Huawei’s position that Digital Financial Services (DFS) offers a new means for people, government and businesses to transact in a cashless way.

“With the pandemic forcing people to socially distance themselves from others, the adoption of DFS has been increasing across countries like Nigeria, Ghana and South Africa. In Kenya where mobile money has already made great inroads, the government has actively promoted cashless transactions as a means to limit contact spread of the virus,” says Edison Xie, Director of Media Affairs, Huawei Southern Africa Region.

A MasterCard global consumer study conducted in April 2020 indicated that 75 percent of South African consumers were using contactless payments with 88 percent of the South African respondents viewing contactless as a cleaner as well as faster way to pay and to limit the amount of time spent in stores.

Estimates for DFS adoption globally may be as high has 67 percent post pandemic adjusted 5-10 percent upwards from pre-pandemic estimates of 57% (Forbes Africa, 2020). Yet for the most marginalised and vulnerable in our economies and in society, some barriers remain that prevent more widespread adoption and use of DSF for remittances.

High cost

“”The most expensive corridors are observed mainly in the Southern African region, with costs as high as 20 percent. At the other end of the spectrum, the less expensive corridors had average costs of less than 3.6 percent,” says Xie.

The World Bank estimated a cost of around 6.7 percent on a remittance value of $200 but for Sub Saharan Africa, this cost rose to 9 percent even through intra-regional migrants in Sub-Saharan Africa comprised over two-thirds of all international migration from the region. The United Nations estimated that between US$200-300 was spent on the costs of transfers (United Nations, 2020).

Xie says that the major contributor to the high costs of remittances is the costly operations of cross border money operators handling cash transfers.

“Reducing the reliance on cash transfers and currency exchanges is thus an important way to reduce remittance costs for those sending money to Sub Saharan countries. Digital money transfer options become essential to facilitating lower costs remittances for migrant workers,” he said.

As DFS adoption increases and the ecosystem expands to bring in more services suited to the market it serves, evolution of the platforms coupled with increased support from government in the form of consumer protection, costs of remittances can be expected to gradually reduce.

Digital Divide

Digital Financial Services allow for a multitude of benefits to be realised for countries and their people. Greater control of funds (how they flow and who they reach), improved accountability in systems and the ability of recipients of funds digitally to better manage resources for their own development. It is important, however, for the full digital financial services ecosystem and value chain to be considered when initiatives are undertaken to improve participation rates.

DFS and remittances will thrive when the basics are in place to ensure every citizen in a country has equal access to the tools to participate in this part of the digital economy. Access to Broadband connectivity, access to smartphones to access digital financial and other services, access to affordable data, relevant content and the ability to understand and use these services are all essential precursors to a fully participative population.

It is therefore crucial for governments across the continent to put their full might behind addressing the digital divide; firstly with widespread, quality Broadband access to all and then reducing barriers to accessing the Internet and digital services with speed.

“Let us use this International Remittance Day to take stock of where we are as countries responding to our people’s needs for services to improve the quality of their lives, in particular financial services,” says Xie

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com