The Uganda Bankers Association (UBA) and Financial Technology Service Providers Association (FITSPA) have signed a strategic collaboration agreement which aims at boosting financial inclusion and innovation in Uganda’s financial service sector.

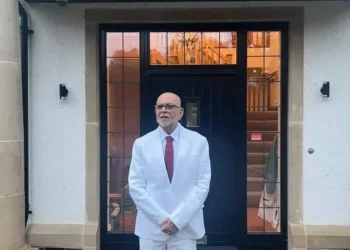

Wilbrod Humphreys Owor, the Executive Director of UBA said that the partnership is going to enable them achieve a tremendous transformation across the industry.

As you know the financial sector like all the other sectors across the country, there’s a lot of transformation that is going on driven by technology. In our case digital financial services, are driving processes, delivery products channels and in Uganda we have FITSPA as well explained that very many or nearly all our institutions partner with to deliver services,” said Mr Owor during the signing of the Memorandum of Understanding (MoU) at the UBA offices on Kampala on Wednesday.

Partnerships between banks and FITSPA are critical in building the digital payments and business infrastructure that can improve proximity and bring harder to reach clients into the financial system at potentially lower costs through innovation.

“FITSPA brings in a lot of value in that today we are able to reach previously very hard to reach areas, new customer segments, new products on a 24/7 basis. This has changed the face of banking and financial services and the partnership couldn’t have come at a better time.

“Most of everything is done through collaborations; you cannot be the expert and good at everything, when you combine heads you deliver more of what typically you would have delivered,” asserted Mr Owor.

On his part, Peter Kawumi, the FITSPA chairperson said the signed MoU has formalized relationships between technology providers who are very aware of how to use several technologies to reach more people and financial sector players who have the trust and the experience in reaching the customers.

“We believe that fintechs have a lot to contribute to this partnership for example fintechs will support banks and other members of UBA to adopt to fast changing technology to respond to customers’ needs in an efficient way. In return we believe that the banks share their experience in use of customer data to create products which are easily adoptable by Ugandans,” said Mr Kawumi.

“Although, we have made significant steps in attracting some investment to drive the use of technologies like mobile banking and agent banking in the financial services and to support economic growth in the country by facilitating financial inclusion, the industry is only in its nascent stage. The partnership with UBA will make us leap forward in many ways.”

Mr Kawumi who is also the General Manager of Interswitch Uganda further noted that partnerships are key to unlocking opportunities and economic growth of a country like Uganda.

“Over the last couple of years there has been a buzz that Banks are in competition with fintechs. The truth of the matter is that without one sector working with another, we will not grow as fast as we can. We will not contribute to the economy as much as we can. So we believe that the signing of the MoU today will help us as different industries working towards the same goal of achieving economic growth of Uganda, of East Africa and of Africa.

FITSPA is a platform that allows for collaboration between market players and stakeholders in the finance and technology ecosystem and it has over 80 members whereas UBA is an umbrella organization for licensed commercial banks supervised by Bank of Uganda. Its membership was extended to other supervised financial institutions (SFIs Tier 2&3) under the associate membership category.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com