The journey of digital financial inclusion within Uganda’s big informal economy continues to make important milestones. This journey is important in the delivery of an economy that works for the many and reducing the cost of doing business.

In May 2022, Airtel Mobile Commerce Limited (AMCUUL), the provider of affordable mobile financial services in Uganda announced the addition of the Merchant Till Number feature for small business owners across the country to able to separate their business finances from their personal Airtel money wallet by using the USSD Code *185*10*10# to create a Unique Merchant Till Number.

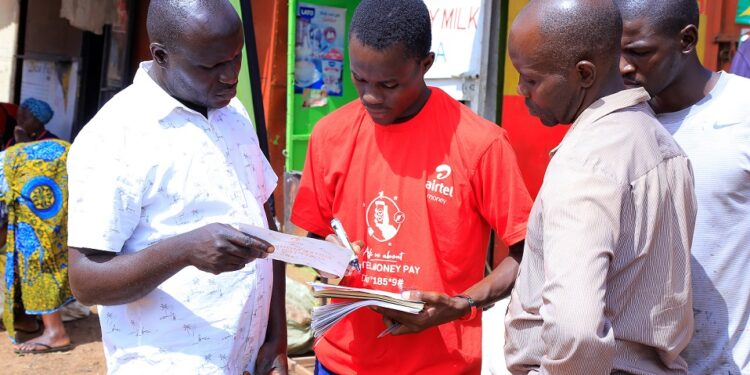

The service was designed to support informal businesses like market vendors, salon operators, boda boda riders on the Airtel network to be able to separate their business money collections from personal money using their existing Airtel SIM cards.

“As a business, we are impressed with the growth in our agent network since we rolled out the product on the market last year, and at the present, we boast of an agent base of about 450,000 business merchants who are spread across the country. This positive performance affirms that innovation and offering the best customer value proposition remains at the helm of Airtel Money’s mandate,” said Japheth Aritho the AMCUL Managing Director.

He added. “We believe that affordability, convenience, and the security of all transactions define simplicity and ease of operations for the customer. With our range of service offering, our customers can now transact via Airtel Money Pay which allows businesses to conveniently receive payments from millions of Airtel Money subscribers at very affordable prices, among other benefits the service presents for businesses and personal financial management.”

The 2021 GSMA report on Mobile Economy in Sub-Saharan Africa projects that the number of unique mobile subscribers will rise by 4.5% to 613 million as smartphone ownership grows to 61% by 2025 from the current 49 percent, and the 2021 GSMA report on the State of the Industry Report on Mobile Money indicated that mobile money transactions grew by 39% to US $ 701.4 billion, moved between 184 million active accounts.

Aritho further revealed, “The increase in mobile phone penetration and mobile financial services as highlighted in the GSMA report presents an opportunity for us to continue to innovate and equally reduce risks that come with holding cash, by designing products like the Merchant Till which allows customers to separate their personal income from business income, thus encouraging better financial management and accountability.”

“Airtel seeks opportunities where it can boost the access of digital financial services among the population so that a small retail shop owner is not afraid to adopt a convenient transaction model like the use of a merchant till for their business since they will now be able to separate their personal savings from their business money. Therefore, we have provided free on-site branding for our registered merchants, and extended training for our franchise partners, which investments are aimed at driving digital inclusion in Uganda,” Aritho concluded.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com