The impact of the COVID-19 pandemic on the global economy and job security for Ugandan migrant workers around the world has reduced the amount of money they are sending back home to their families. But remittances still provide crucial support for some of the world’s poorest people.

Recent data from the May Migration and Development Brief shows that remittance flows to Uganda declined by 26 per cent, from US$1.4 billion in 2019 to US$1.1 billion in 2020. Yet despite the decline, Uganda was ranked among the top ten recipient countries in sub-Saharan Africa (SSA).

For millions of households that depend on remittances, the decline only underscores the role these private transfers of funds play in safeguarding their food security, health care, savings and investment opportunities.

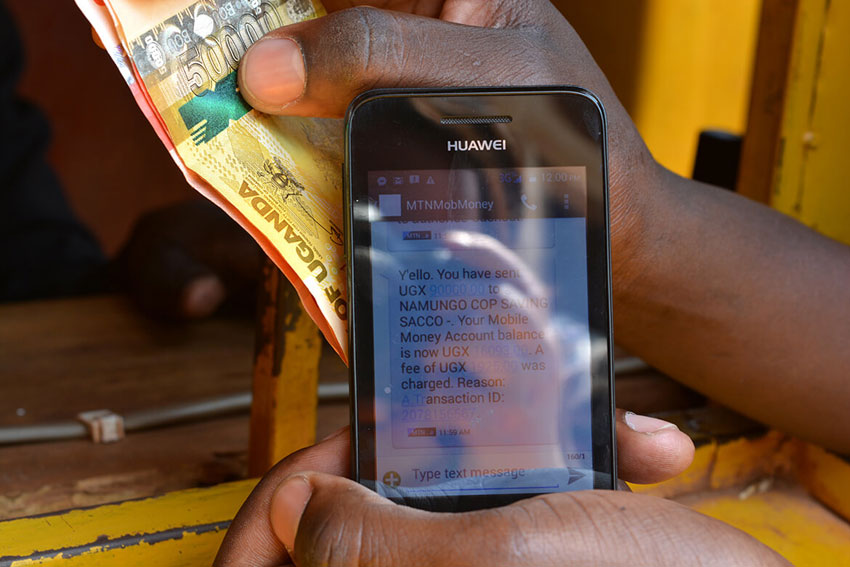

Uganda’s mobile money service is one of the most integrated globally, especially for cross-border mobile money services. Existing services allow people to receive money from four countries in SSA and send it from wallet to wallet to six different countries in the region.

Uganda remittances

A recent study by the International Fund for Agricultural Development (IFAD), on remittances to Uganda highlights the fact that innovative solutions have the potential to increase access to and use of remittances received by households for greater financial inclusion and investment opportunities. The study also recommends specific actions to safeguard and recover from the COVID-19 crisis.

To help catalyse growth in the market, IFAD has launched a national call for proposals under its Platform for Remittances, Investment and Migrants’ Entrepreneurship (PRIME) Africa programme in collaboration with the European Union. The aim is to identify and support initiatives that reduce transaction costs, accelerate digitalization, leverage remittances to deepen financial inclusion and expand formal channels.

“While there has been a great transition to digital financial services, the key concern for Uganda remains to make money transfer safer, more secure and cost-effective,” said Tilda Nabbanja Acting Head of the Financial Inclusion division of the Bank of Uganda. “Greater financial literacy, innovations in service delivery and synergies among the development institutions, private and public sectors have to be built, in order to promote financial inclusion in the country.”

The average cost of sending money to Uganda remains high at 8.7 per cent, double the Sustainable Development Goal’s (SDG) recommended target of 3 per cent. But the pending National Payment Systems Act has the potential to achieve the set SDG target, create an enabling environment for digital financial and payment service providers, and increase competition and consumer protection.

“As all governments plan for recovery strategies, it is crucial to facilitate the contribution that 200 million migrants make to over 800 million family members around the world,” said Pedro De Vasconcelos, Manager of IFAD’s Financing Facility for Remittances.

“The opportunity for Uganda today is not only to make remittances cheaper as per the SDG target, but also to make them count for the millions of families that receive them. That will give families with greater financial options in their daily lives and ensure greater resilience, particularly in times of crisis,” he added.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com