By Stephen Kalema

Bank of Uganda closed seven commercial banks to protect the country’s banking system.

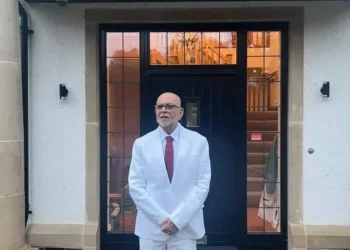

Emmanuel Tumusimme Mutebile, the central bank governor made the revelation on Thursday while appearing before the parliamentary committee on Commissions, Statutory Authorities and State Enterprises (cosase) on the ongoing probe into the closure of the banks in question.

He said the Central Bank was right to intervene and close down the seven defunct banks and will never regret making such decisions.

“Let it be clear that Bank of Uganda was right to intervene in the financial institutions. Any delay to act or lack of decisiveness on the action taken would have created financial crisis, danger to savers, borrowers, businesses and the economy at large,” said Mutebile.

Mutebile reminded the committee about the financial global crisis which happened 10 years back due to lack of strong decisions.

“In 2008, due to lack of decisiveness from regulators there was global financial crisis. Bank of Uganda was not willing to see this happening,” added Mutebile.

“If we had not taken such decisions, the committee I am appearing before now, would be asking me and my officials where was the central bank. However, we take comfort that we are not answering such questions rather being asked how we defended the economy,” said Mutebile.

Mutebile emphasized that Bank of Uganda’s actions towards the seven banks or any financial institutions was in good faith for all Ugandans. “Our actions towards all banks in question is and was intentioned to protect depositors, increasing confidence in the banking and fostering financial sector stability and this has been in achieved in all sections we have interfered.”

However, Mutebile appreciated Cosase, for giving Bank of Uganda officials an opportunity to respond to questions raised by the Auditor general’s report.

“I thank you in particular for your frank approach on issues that we thought needed to have been addressed. Also express my appreciations to the Auditor general for his report which has raised issues which will help to improve the operation of Bank of Uganda, and I know this process has been a learning lesson to BOU management and staff,” said Mutebile.

He added that Central bank recognizes the significance of the evidence that has been presented and is confident that it will increase transparency and accountability which the bank tends to maintain.

The seven closed banks include Greenland Bank, Teefe Bank, International Credit Bank, Cooperative bank ,National Bank of Commerce, Global Trust Bank and Crane Bank Limited.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com