RippleNami Inc, an American company that was contracted in June, 2020 by the government of Uganda to provide a solution to improve rental income tax compliance for the East African country is in trouble over patent rights.

Investigations indicate that the company had lost a patent case a week before it signed a deal with Uganda. Currently, it is not clear whether RippleNami will continue with the contract because it does not own the system it said it would deploy while executing its role.

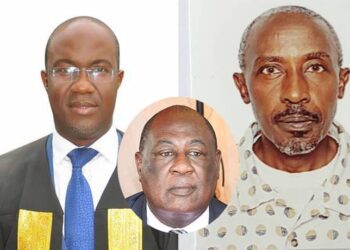

In the recent ruling, the US Patent Trial and Appeal Board administrative judges Jeremy J. Curcuri, Irvin E. Branch and Phillip A. Bennett rejected RippleNami’s patent claims as being directed to an ‘abstract idea’.

The decision instead went in favour of inventors Phillip Randall Gahn, Richard James Hinrichs and Julianne Connolly.

According to New Vision newspaper, the board, which is the highest level of appeal, found RippleNami’s proposed patent claims comprising a data visualization mapping platform to lack any ‘inventive concept’ and were instead a ‘routine and convectional’ subject matter.

“The appellant (RippleNami) argues that the claims are not directed to an abstract idea because they are rooted in computer technology and address problems that arise in computer technology. We disagree,”the judges ruled.

“The problem of combining different types of information for visual Geospatial representation for situational and spatial comparisons alleged by the appellant to be unique to the computer technology, exists also in the context of paper geographical maps.”

Meanwhile, this could have very serious implications for Uganda. A highly placed source warned that if RippleNami proceeds to use the ‘Rwave’ or other services in Uganda, they would be violating someone else’s Intellectual Property (IP).

” The IP includes source code protections and algorithms. Not only could a third-party sue RippleNami for the revenue they received from the contract, the third-party could seek an injunction prohibiting RippleNami from using software or other features/services protected by such IP, “the source said.

Adding,” If Uganda Revenue Authority is one month or two years into the project, that could have serious consequences for the institution as all worked performed may be lost. RippleNami’s rejected patent application discusses only a few generic mapping technology. ”

Speaking to the local daily, Jim Mugunga, the Finance Ministry spokesperson said he was not aware of the judgment that when against RippleNami.

Mugunga noted that he was not certain whether information on the legal process at the US Patent and Trademark Office had been availed to the Finance Ministry.

Faruk Awadh, RippleNami’s director for operations in Africa, said “I do not have any comment on that at a moment. Thank you.”

While signing the agreement last month with the Ministry of Finance, RippleNami revealed that their system would integrate data from various Ministries, Departments and Agencies (MDA’s) to enable proper identification of individuals and Corporations to determine rental income prior to standard deductions.

The signing of the agreement followed continued tax evasion and under declaration of rental tax income. URA has been faced with low rental income tax collections over the years.

Finance Minister Matia Kasaija who witnessed the signing ceremony urged Uganda Revenue Authority to collaborate with Ripplenami in solving uncollected rental income tax issues.

“On behalf of Government of Uganda, I congratulate all of us who have been involved in one way or another for having patiently worked through this,” said Kasaija.

He called upon Ripplenani to start working at the beginning of the new financial year 2020/2021, adding that Government needs more revenue to meet its expenditure pressures.

For the Property owners, Kasaija urged them not to feel agitated and think that Government is trying to squeeze them.

“Paying taxes is a noble job of any citizen and it is Biblical. I know many people don’t like to pay taxes, but it’s a noble action that every citizen should undertake with open hands,” said the Finance Minister adding that Ugandans who don’t pay taxes are cheating themselves.

RippleNami was tasked to develop and deploy a rental tax compliance system that would integrate data between the various government agencies to enable proper identification of individuals, and companies that own rentable property and possible rental income tax payable.

The URA was to be the primary end user of information and reports generated by the rental tax compliance system.

John Musinguzi Rujoki the URA Commissioner General said URA will work closely with Government Agencies such as Ministry of Lands, NIRA, KCCA,URSB and utility companies to provide the necessary data which will be integrated with the RippleNami technology.

RippleNami would identify properties and assign them geo-addresses in accordance with internationally accepted standards, link the identified properties to their owners or the persons who earn income from those properties and cross match the identified properties and their ownership with the URA TIN database.

The company is also supposed to determine the nature of occupancy i.e. whether a property is owner-occupied or rented out, determine the occupancy period, providing for current and previous periods, determine the estimated rental income assessable to rental tax to be paid prior to standard deductions from each property and by each property owner and provide a clear address for each property identified for ease of reference.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com