Somebody I know wanted to capitalize his business and decided to approach one of Uganda’s biggest commercial banks. When his business was booming, he had built some houses in Namugongo, not very far from the famous Uganda martyrs’ shrine. Four houses on about 15 decimals of land.

The houses, each two bedrooms, two bathrooms, kitchen and dining rooms were occupied by tenants each paying Shs1m per a month, totaling a gross income of Shs4m per a month or Shs48m per a year. He was willing to stake it as collateral for the loan. The bank sent their prequalified asset valuer, one of those companies that manage Kampala’s elite malls.

The moment he signed the form that authorized the bank to pay their valuer Shs3m for the exercise, they showed up promptly. Within a week or so, the bank called him and handed him the asset valuer’s report. The report indicated that an empty plot of land in the area of the same size was valued at Shs100m. But then something strange happened afterwards.

The asset valuer said that the four houses were valued at Shs120m on the open market while putting the forced sale value at Shs80m. He protested the bank valuer’s report and asked if the bank could send another valuer who knows what they were doing. The bank said they trust their valuer with their life and there was no need to send another valuer. He wondered if in their own wisdom they really think the houses that gross Shs4m a month, Shs48m a year could really be worth 20m excluding the land and they said that is what the valuer’s report says.

He walked out of the meeting protesting and cursing them for making him lose his Shs3m while enriching an incompetent valuer. He called it a scam. I am not sure it wasn’t. I wouldn’t have believed anything he said had he not turned up with a copy of the report for me to read. May be the bank didn’t want to lend him money or something. It just didn’t make sense.

Anyway, two things happened a week or so ago that explain the predicament of Ugandans when it comes to credit. There is a new law that limits interest rates charged by informal money lenders at 2.8% per a month or 33.6% annually. Currently, money lenders charge as much as 12% per a month on loans advanced. Such money lenders include mobile money companies.

The money lenders’ association chairman argued Uganda is a free economy and parliament should put such restrictions on money from government. Not on his private money whose source they don’t know.

Many people after borrowing this money fail to pay. You have to be a money launderer or thief to borrow money at 10-12% per a month and be able to pay it back but people are desperate. And the money lenders are even more desperate to get their money back.

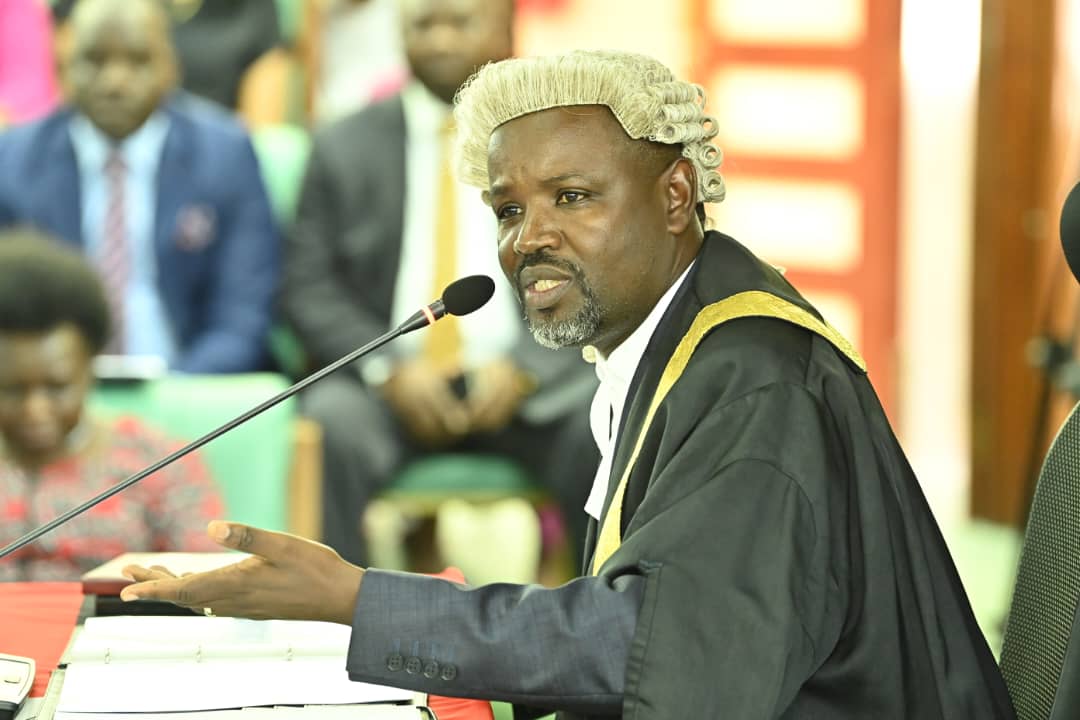

One such desperate lender called the Deputy Speaker of Parliament on Thursday morning and threatened to teach him a lesson if somebody he knew didn’t pay. The Deputy Speaker said on his X social media handle that the caller identified herself as an employee of Mangu Cash, a mobile money lender that advances micro credits to millions of Ugandans via their mobile phones. The Mangu Cash lady said the borrower had listed the Deputy Speaker as his next of kin. He tagged the police chief to do his job and stop such people from harassing Ugandans. The next day, the Deputy Speaker posted about regulation and all sorts of things that he is going to do after realizing that this wasn’t an isolated incident.

I don’t know how many times Mangu Cash and a few other such lenders have called me about people I don’t even regularly speak to about their obligations to pay back. I have been blocking whichever such number that calls me since I was never involved in the first place when they were advancing money. Many people have complained about their modus operandi.

But I don’t think they are the problem. If regulated credit institutions were not taking clients into circles before lending them like they did to my Namugongo friend (he didn’t actually borrow), the likes of Mangu Cash would not exist. Their existence shows the gap that needs to be filled.

If the Deputy Speaker is desirous of doing something about credit in Uganda, he needs to look at the whole picture and find ways through which credit can easily be affordable and accessible to the majority of Ugandans otherwise informal lenders will just go underground and make the situation worse than it already is. An economy where interest rates are as high as they are by even regulated lenders cannot spur sustainable growth.

The writer is a communication and visibility consultant. djjuuko@gmail.com

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article