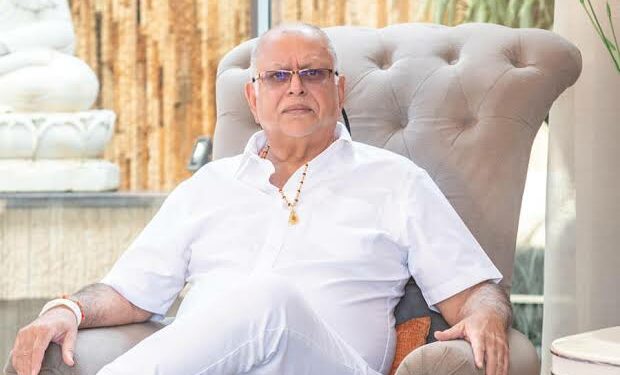

In a significant legal victory, Sudhir Ruparelia, renowned Ugandan business magnate and Chairman of the Ruparelia Group, successfully defended against dfcu Bank in a UK court ruling on October 30, 2024. Mr. Justice Stephen Hofmeyr KC dismissed dfcu Bank’s request for Ruparelia and his associates from Crane Bank to post security for costs, paving the way for their compensation claims to proceed.

The suit, filed by Crane Bank and its shareholders, seeks over $200 million in damages, alleging a fraudulent scheme involving former Bank of Uganda officials and dfcu Bank executives. The claim asserts that these officials conspired to seize control of Crane Bank, ultimately selling it at a gross undervalue, benefiting key individuals involved in the sale. As Mr. Justice Hofmeyr ruled, “the applications for security are dismissed.”

This case follows an earlier UK Court of Appeal ruling allowing Crane Bank’s claims to proceed despite the “foreign act of state doctrine,” which typically restricts English courts from adjudicating issues tied to foreign governmental actions. The court ruled that Crane Bank’s allegations fall under the commercial activity exception, given the public policy imperative of combating corruption and bribery.

Crane Bank shareholders stated: “Crane Bank and its shareholders will continue to vigorously pursue their claim as part of a fair legal process before the English courts.” This ruling adds momentum to Crane Bank’s pursuit of justice and recovery from the controversial 2016 sale to dfcu Bank, which was once one of Uganda’s largest commercial banks.

The court’s decision underscores the UK’s stance against shielding corruption and marks a step forward in Crane Bank’s complex legal journey.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com