Equity Bank, a prestigious institution in the area of financial education and inclusion has once again been recognized for its commitment towards achieving this. Equity Bank has emerged as an empowerment icon, through innovative projects and perseverance, to ensure that every individual can be empowered with the right information needed to manoeuvre complexities brought about by financial issues.

The reward received from the Uganda Financial Literacy Association (UFLA), an umbrella body which unites stakeholders in the financial literacy field, is not only a testament to the unwavering dedication demonstrated by the bank but it also shows how much impact they have had on communities within the region.

At the heart of Equity Bank’s mission is a deep conviction that education is at the forefront of societal transformation. In the realization that financial literacy plays an essential role in empowering people economically, there have been various initiatives aimed at providing people with know-how on making rational decisions concerning finance led by Equity Bank.

By bridging gaps between financial exclusion and inclusion, Equity Bank has developed comprehensive educational programs, interactive workshops and digital resources to empower people to take charge of their future money matters.

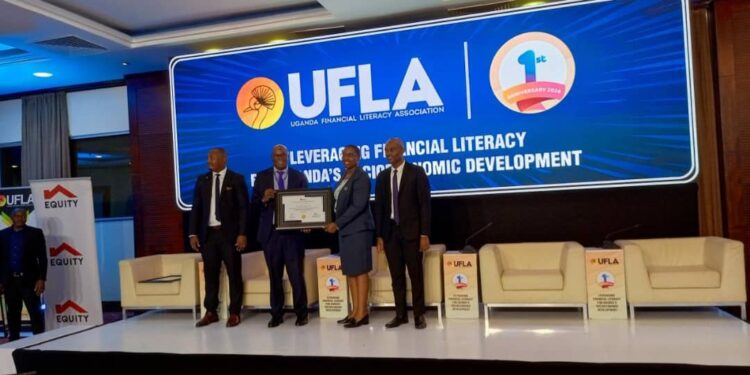

Equity’s contribution to advancing the national financial literacy agenda was recognised at the UFLA’s first-anniversary celebration at Kampala Serena Hotel.

Elizabeth Mwerinde Kasedde, the Executive Director of Equity Bank, spoke to the people at the event about how her company was dedicated to offering comprehensive financial services. She pointed out that Equity Bank has prioritized social and economic empowerment for its customers, companies and society. Being proactive in the establishment of financial inclusion is what differentiates Equity Bank from other banks since it goes beyond just banking and focuses on whole approaches that uplift individuals while ensuring communal prosperity.

“Equity Bank targets the unbanked, financially excluded such as women, youth and refugees, and so far we have covered up to 67 per cent rural and 32 per cent urban,” he said.

The bank has in the last two years trained 126,107 youth, women, and refugees in financial literacy and entrepreneurship education, of which 58 per cent are female, 77 per cent are youth and 30 per cent are refugees.

According to Mwerinde, the impact of financial literacy and entrepreneurship education has been enormous. “We have witnessed increased access to affordable unsecured credit. Up to UGX 89 billion has been disbursed in the last three years including the Covid-19 period.

The bank has also created 99,000 jobs and expanded 6,420 Micro enterprises from micro-level (Capital size below UGX 10 million) to small size (capital size above UGX 10 million) and has improved the longevity of the enterprises with up to 82 per cent of the enterprises in operation for over 12 months.

Since the start of the Bank’s effort in promoting financial inclusion in 2019, 87 per cent of the unbanked have reported improved livelihood and more individuals are joining village Sacco’s and associations “because there is more opportunity to access formal financial services cheaply,” said, Mwerinde.

“We are honoured to receive this award. We believe that empowering individuals with financial knowledge is essential for fostering economic growth and improving livelihoods,” Mwerinde said on receiving the award.

The reward for Equity Bank, however, proves its commitment to financial independence and personal security. The bank provides financial services that are accessible and comprehensive in order to enable people make decisions about their monies. This aims at ensuring that there is stability and self-reliance among the communities.

Besides the bank’s recognition, Phillip Kiryowa was awarded the coveted Financial Literacy Trainer Award which distinguishes him as an outstanding teacher of personal finance in Equity Bank among others. This award emphasizes his remarkable efforts to improve knowledge about business legitimacy, thereby cementing Equity Bank’s standing as a pioneer of financial education as well as inclusion.

Meanwhile, the theme for the event, “Leveraging Financial Literacy for Uganda’s Social Economic Development,” aligns directly with Equity’s vision and mission to champion the socio-economic prosperity of the people of Africa.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com