The Ugandan government has unveiled an intricate roadmap, the five-year Public Debt Management Framework (PDMF), aimed at recalibrating the nation’s economic trajectory.

Crafted by the Ministry of Finance, Planning, and Economic Development, this strategic initiative seeks to instill financial resilience and ensure the sustainability of Uganda’s public debt.

The backdrop of this development is a protracted debate spanning the last four years, with concerns about the nation’s ability to manage its debt, which has oscillated between 48 and 52 percent of the GDP.

Acknowledging the breach of critical borrowing benchmarks, the government concedes its shortcomings in fiscal consolidation, signaling a need for corrective measures.

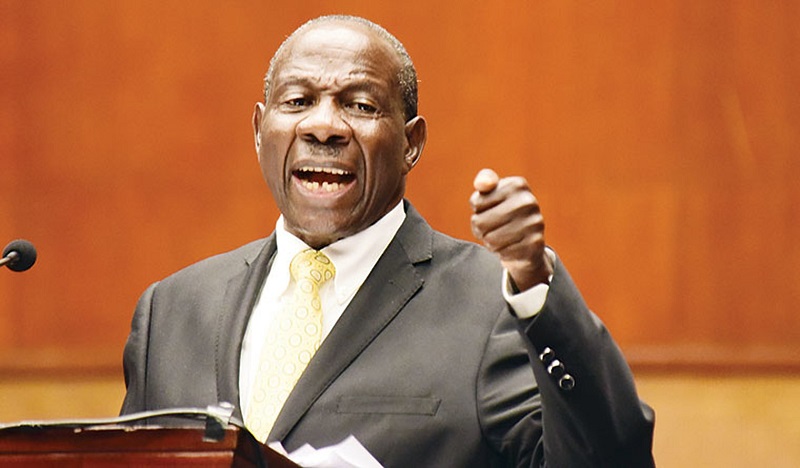

Finance Minister Matia Kasaija has articulated a dual commitment: maintaining debt at manageable levels and directing funds toward pivotal areas such as critical infrastructure, social programs, and economic growth initiatives.

The PDMF, described as a “comprehensive tool for managing public debt and other financial liabilities,” outlines multifaceted strategies.

The government’s proactive stance includes the development of an exhaustive debt management strategy, fostering robust relationships with international lenders for low-interest capital, enhancing risk management practices, and exploring innovative financing solutions, notably green and sustainable bonds that align with environmental and social goals.

A disconcerting revelation emerges from the June 2023 data, with domestic arrears reaching an alarming 2.714 trillion Shillings.

In response, the PDMF mandates a comprehensive review, with a commitment to cap interest payments on both domestic and external debt at 20 percent of the government’s total revenue, excluding grants.

Ambitious targets underscore the government’s determination, aiming to slash the total debt service to revenues threshold from 32.9 percent in June 2023 to a mere 2 percent by the end of the five-year period.

Domestic debt parameters, such as the Domestic Debt to GDP ratio and domestic interest payments, are capped to instill financial prudence and accountability.

Permanent Secretary in the Finance Ministry Ramathan Ggoobi underscores the PDMF’s role in assessing the cost and risk of the external and domestic debt portfolio.

The framework introduces stringent benchmarks and limits, holding entities accountable for adhering to borrowing and financing guidelines. Notably, Ministries, Departments, and Agencies (MDAs) face restrictions on external financing for projects lacking earmarked government contributions.

In a notable departure from convention, the Ugandan government has taken the unprecedented step of forbidding the issuance of Eurobonds over the next five years.

Eurobonds, while a convenient debt instrument, carry inherent risks tied to fluctuating interest rates influenced by macroeconomic changes in the issuing country. This decisive move underscores Uganda’s commitment to fiscal responsibility and minimizing exposure to external market uncertainties.

As Uganda embarks on this rigorous debt management journey, all eyes are on the government to witness the tangible impact of these measures on steering the nation toward economic stability and sustainable development.

The PDMF represents a pivotal chapter in Uganda’s financial narrative, with the hope that meticulous planning and stringent adherence will pave the way for a resilient and prosperous future.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com