Uganda Development Bank (UDB) has launched a Climate Finance Facility (CFF) worth Shs50 billion to promote Green Economy and to mobilize capital from domestic and external sources for low-carbon and climate-resilient investments.

The Facility is a special-purpose vehicle with a unique and specific focus on finance to unlock and catalyse private sector investment in enterprises that drive green impact and financial inclusion

The CFF is also a strategic Fund that will make available affordable finance that aims to promote climate-smart agriculture and ensure climate-resilient infrastructure and low-carbon industries.

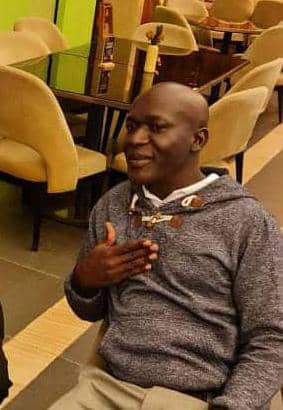

While speaking during the launch on Wednesday at Mestil Hotel in Kampala, the Managing Director- UDB Ms Patricia Ojangole said that the increasing threat of climate change and environmental degradation has the potential to present high socio-economic risks to the economy.

“Such impacts have continued to manifest through floods, drought, landslides animal and crop epidemics among other signs in different parts of the country. They are more deleterious to the poor and marginalized who depend largely on natural resources for their livelihoods.”

She noted that over 70 per cent of Ugandans depend heavily on micro, small, and medium enterprises (MSMEs) for employment, and these generally have less capacity to withstand financial shocks.

“The vulnerability of Uganda’s population requires the urgent need to adapt and maintain future economic growth opportunities by transitioning to a low carbon (green) economy, This will require massive investment in green technologies. Green finance will be central to providing the flows of capital required. This is primarily driven by the fact that most green technologies are characterized by high capital intensity and consequently nigh upfront financing requirements,” Ms Ojangole explained.

She also noted that as a financial intermediary, UDB will stimulate green economic growth by coordinating green financing options, mobilizing and increasing access to green finance by structuring and providing products to address market gaps including risk mitigation products and providing the right products to address investment demand in the green sector.

“There have been commendable efforts by the Government in establishing structures and policies to advance climate action. Progress is ongoing in scaling up local community solutions to manage climate impacts. However, it is now time for financial institutions and private sector players to get involved. That’s why we are committing Shs50 billion towards the capitalization of this facility. This is expected to grow with support from various partners over time,” she said.

The strategy by UDB was also welcomed by the Permanent Secretary/Secretary to the Treasury, Mr. Ramathan Ggoobi who said that CFF is very strategic and timely as Uganda and the world at large, more than ever, commit to devise mechanisms to address the threat of climate change.

“I would like to thank UDB for this intervention. Without appropriate funding, we cannot build the capacity to adapt to these impacts, mitigate these impacts or even build resilience. Am delighted that financial institutions are starting to realize their role in the climate change agenda and strategically getting involved,” said Mr. Ggoobi.

Mr. Ggoobi noted that the potential of Climate Finance is significantly providing targeted Financing adaptation and mitigation to significantly reduce the impact of climate change on Uganda.

“This could include among other support the development of climate resilient practices, especially in agriculture, mining and many other extractives which are a bedrock of our economy but in promoting renewable energy development. Therefore, I’m delighted to see that our bank is taking a lead in actualizing some of these aspects. Also, the launch of the Climate Finance Facility signifies an important step towards securing our future for us and our children. I therefore in a special thank the entire management of UDB for this initiative of establishing this facility,” he said.

The initiative will foster climate-conscious change in investments with a clear objective of building climate resilience among the businesses supported. The intention is to build climate-proof businesses as this is a better strategy for building long-term viable enterprises that are adaptive to climate impacts and seek a low-carbon development pathway.

The move to create a Climate Finance Facility builds on the Bank’s successful Initiatives to foster innovation, engender holistic sustainability, and increase interest in green technologies.

In line with Bank’s priority sectors, the facility shall target investments in Climate Smart Agriculture Low Carbon industries, Climate Resilient Infrastructure, and cross-cutting projects like sustainable waste management, clean energy-renewable energy and energy efficient projects, sustainable water resources management, eco-tourism and related investments.

Dr Francis Mwesigye, UDB’s Chief Economist revealed that UDB is looking to be the source of capital for low-carbon and climate adaptation projects in Uganda by offering instruments like equity, asset finance, and project preparation to influence the development of green innovations.

“In 2019, UDB set up this unit. We have now put in place the right policies to launch the UDB Climate Finance Facility and target climate change mitigation initiatives aligned with Agriculture, Manufacturing, Infrastructure, Human Capital Development and Tourism,” he said.

Meanwhile, the facility will target climate change mitigation and adaptation initiatives that are aligned with the Bank’s priority sectors. The facility will provide opportunities along value chains and supply chains that target to combat climate change impact through evidence-based and innovative climate-smart technologies

Target initiatives will include Climate Smart Agriculture and Agribusiness, Low carbon industry, Climate Resilient infrastructure, Eco-Tourism Clean energy and Sustainable waste management.

The beneficiaries will also be exposed to the Bank’s Green Investment Advisory as well as the Project Preparation Support to make them bankable but more importantly, grow them to become viable green businesses. Investments shall demonstrate compliance with environmental sustainability and climate action.

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article