The Democratic Republic of Congo, sub-Sahara’s largest country, became the 7th member state of the East African Community (EAC) on 29th March 2022, joining Burundi, Kenya, Rwanda, South Sudan, Tanzania, and Uganda. This development comes with many advantages including easy access to key raw materials to support the region’s industrialization agenda, improved Intra-trade, Connectivity, Trade and investment, Continental market, and tourism opportunities among others. DR Congo has a rich portfolio of precious metals including cobalt, gold, diamond, aluminum, copper, and other precious minerals, and other natural resources that will be of mutual benefit to its EAC partners. The global commodity prices of the raw materials that the DRC produces are at an all-time high. As the world aspires to go green, the biggest driver is demand for green locomotive energy. Currently, 70 percent of coltan and cobalt comes from the DRC, and the highest copper quality in the world, accounting for 30 percent of the world’s supply. Cobalt is used in the manufacture of batteries while copper is used in the assembly of electric cars and the infrastructure of most renewable energy sources.

However, DR Congo comes with a burden of unending conflict. In fact, it has been tagged a ‘problem child’ (Luke and Vicent, 2022). Despite its wealth, it is one of the poorest and most underdeveloped countries in Africa. Congo’s natural resources appear to be more of a curse than a blessing, as they have arguably brought limited gains to its economy or citizens. The unending conflict has consistently ravaged the country, claiming the lives of more than five million people since 1998, driving millions more into starvation and exposing them to diseases, and has resulted in human rights violation, where millions of women and girls have been raped.

Nonetheless, trade in Eastern Africa is set for a boost after accession to the EAC by DR Congo. The admission of the DRC into the EAC, with a population of 90 million people, could be a game-changer in a region where intra-trade suffered shocks due to the Covid-19 pandemic. The new EAC now offers a combined market-driven economy of 285 million people and a GDP of $275 billion (World Bank, 2020). With this bloc now stretching from the Indian Ocean in the East to the Atlantic in the west, the DRC presents the potential to open the Indian Ocean to the Atlantic Trade Corridor and link the region to Central Africa, North Africa, and other continental sub-regions. More cargo is expected to shift from the Northern Corridor to the Central Corridor. Truckers are weighing their options on which route to use to ferry goods to the vast DRC.

DRC’s entry means integrating the EAC’s trade infrastructure, intermodal connectivity, one-stop border posts, and systems to reduce trade time and costs. With lower tariffs on goods and the removal of trading restrictions among partner states, goods and services will move more freely. With a larger market, manufacturers in the EAC will benefit from economies of scale, making them increasingly efficient and competitive. DR Congo’s admission is a milestone in the transformation of the bloc into the most attractive trade and investment destination in Africa.

According to the East African Business Council, EAC’s exports to the DRC have averaged 13.5 percent in the last seven years to 2020. In 2018, the value of imported goods into the DRC stood at $7.4 billion against exports of $855.4 million. Following this milestone, trade is set to increase immensely, as DRC shares its borders with five EAC partner states.

Relatedly, the study by the Economic Policy Research Centre (2021) revealed that DRC’s membership to the EAC will potentially increase exports of Rwanda by USD 81 million, Uganda (USD 60 million), Tanzania (USD 50 million), Kenya (USD 42 million) and Burundi (USD 6 million). The positive trade effects are attributed to trade creation (due to new exports by EAC to DRC initially sourced from non-EAC countries) rather than trade diversion. In terms of trade growth shares, it is estimated that free trade with DRC increases the current trade with Uganda by 30 percent, 24 percent for Rwanda, 34 percent for Tanzania, 29 percent for Kenya and 33 percent for Burundi (EPRC, 2021). The main economic sectors/industries poised to benefit from DRC membership include Agro-processing, metal products (mainly iron and steel) and mineral ores industries.

DRC along with Tanzania, is a Southern Africa Development Community (SADC) member state and its entry into the EAC strengthens the EAC-SADC bridge, bolsters ongoing bilateral negotiations for a Grand Free Trade Area between EAC, SADC and COMESA. Even before its admission, EAC individual countries had already signed bilateral deals with Kinshasa. For example, Uganda and Rwanda are already constructing three roads into eastern DRC to ease business and increase trade and investment between them.

In the region, Uganda is the second largest exporter to Congo, after Rwanda. Uganda mainly sells cement, cooking oil, rice, sugar and tubes and pipes. It also exports food and traders hope Congo will provide market for products such as food, spirits, textiles, plastics, and others. Overall, the accession to the EAC by DR Congo calls for strategic investments in these strategic commodities while addressing Non-Trade Barriers (NTBs) such as poor infrastructure and insecurity in parts of DRC. To this end, the Government of Uganda continues to strengthen the capital base of Uganda Development Bank (UDB) to avail affordable medium to long term credit to support SMEs and large-scale enterprises, including export-oriented producers. This is fundamental for Uganda’s export trade in the region and beyond, as the country strives to tap into the opportunities DR Congo brings to EAC table.

Currently, UDB provides concessional loans coupled with business advisory and project preparation services SMEs and large-scale enterprises, mainly in primary agriculture, Agro Industrialisation and manufacturing, among others, aimed at production for local, regional and international markets. The export trade loans facilitate export-oriented investment and trade activities while the business advisory services help to promote professionalism among entrepreneurs/traders and reduce the risk of default. The UDB export trade funded projects generate jobs, contribute to Gross Domestic product (GDP), tax revenue and most importantly generate foreign exchange earnings to improve Uganda’s trade balance. In fact, in February 2022, Uganda’s trade balance improved by 9% to a deficit of US$ 247.7 million from a deficit of US$271.3 million in January 2022, according to Bank of Uganda latest Statistics.

As the export trade opportunities increase regionally, UDB should deliberately extend export promotion financing model to Uganda’s companies operating in DRC and in other countries in the region and beyond. For instance, Kenyan firms have already shown interest in expanding investment in the DRC, and last year, Equity Group, the commercial banking group in East Africa, sponsored a two-week trade mission as they announced plans to fund Kenyan businesses setting up shop or expanding into the country. With this holistic approach of financing export-oriented producers, and export of Uganda’s products, the export revenues will rise to create significant impact on the trade balance, for sustainable development, poverty alleviation and improvement of the quality of life of Ugandans.

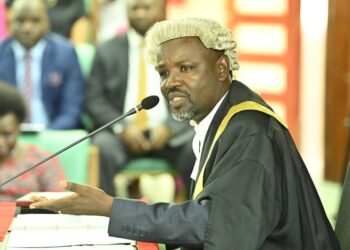

Bob Twinomugisha is an economist with the Uganda Development Bank Ltd

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com