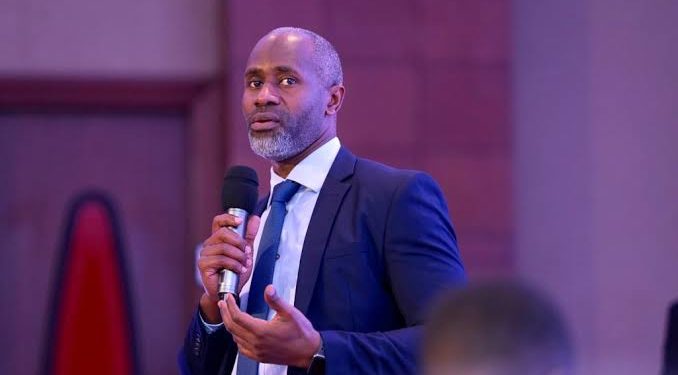

Chris Lukolyo, the Digital Country Lead at United Nations Capital Development Fund (UNCDF) has revealed that despite the presence of policies in Uganda, there’s a very big gap as far as digital inclusiveness across the country is concerned.

Mr Lukolyo made his observation during the advisory board meeting with members from different ministries and government agencies on Tuesday. He said that when it comes to coming up with policies, Uganda is way far better in all East African countries but the implementation is still wanting. He added that a digital inclusive economy can only be built by measuring the performance of policies set in place.

Using the results from the Inclusive Digital Economic Scorecard of 2021, Mr Lukolyo said that on policy formation, Uganda scores very high however when it comes to digital inclusiveness country is still struggling because so many individuals are left behind since there are always limited skills among policymakers to leverage digital technology in implementing the existing policies.

“Policies are in place but how do you implement them to ensure that technology is used to enable inclusiveness? Sometimes there is a misalignment between the policy and the market needs. The government needs to get revenue but at the same time the tax comes in and distracts the market, are they aligned? Digital privacy is also a challenge and if citizens are not comfortable with these platforms, they will not use them. A good policy must be trusted,” he said.

Mr Lukolyo also added that there’s an issue of poor quality innovations inspite the fact that many of them are always coming up.

“Innovations are low in performance since they are struggling for capital. UNCDF may provide for a grant to enable business model but it’s still important that business can attract capital from Equity bank to grow therefore there’s still inexperience of the innovators in raising capital. That is why UNCDF advised them and they came up with an organization ‘Start-up Uganda’ with the idea of learning from each other to formalize their businesses.”

He also said there’s a challenge of high cost of connectivity and low network coverage which makes digital inclusiveness very hard especially in rural areas.

“People in such areas don’t only face poor network but also agency access is very poor especially for Fintechs. This adds to the low penetration of smartphones and this impacts how much people can use services on such phones. On top of this, there’s also limited access to energy.”

Mr Lukolyo further disclosed that other constraints hindering digital inclusiveness include; low levels of digital literacy among the working population in Uganda and low digital and financial literacy among women.

Reacting to Mr Lukolyo’s presentation, Mackay Aomu, the Director of Bank of Uganda advised that innovators not to only focus on what they want to do rather they should also consult and see the views of their possible funders.

“Innovators must find out the need of the financers because each market has its own mechanisms, they should not focus on what they want only. How about if the funder asks and say this is what I want and able to fund because it speaks to the market.”

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com