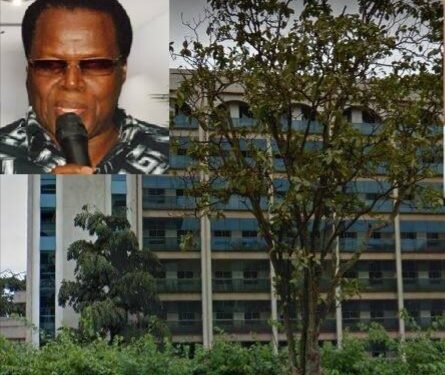

Since former civil servant cum businessman Peter Kamya lost properties including prime building, Simbamanyo House, social media has been awash with discussion, some of which wondering how a government worker made money to own property including the much-talked building which hosts the Ministry of Gender on Lumumba Road in Kampala city.

However, Simbamanyo House is not the last property Mr Kamya is actually likely to lose as his accumulated debt deadlines catch up with him – and his court gymnastics not bearing much fruit.

Kamya’s woes got more publicity after property mogul Sudhir Ruparelia bought off Sibamanyo House property from Equity bank at sh18. 5billion in an auction deal. The bank wanted to recover an unpaid loan of $8.1 million from Simbamanyo Estates Limited owned by Mr Kamya.

Since the deal, Kamya not only went to court to stop the move, like he always does in other loan deals he has failed to honour, however, he has added an orchestrated smear attack targeting the person of Sudhir Ruparelia, blaming him for buying a building which the bank had put on sale.

If Mr Kamya had picked tips from Sudhir on how to grow and sustain a property empire, maybe, he would not be fighting a losing battle.

The architect of Ruparelia Group business empire, once warned about borrowing to expand business and it seems Mr Kamya fell into this trap.

“Avoid borrowing if you can,” Sudhir once told Billionaire Tomorrow media, advising instead, “First, try and grow according to the cash flow you have and are creating. It is probably the best option. Because the truth is said, opportunities come all the time, especially when you have good cash flow. Take those opportunities.”

In that same statement, one can explain what befell Mr Kamya and also, why Sudhir, who keeps watching his cashflow, was able to buy off the building which is making headlines.

Kamya, then a civil servant working as a commissioner at the Ministry of Lands, grew an appetite for property. He wanted to expand his business interests in the hospitality industry.

Through his Simbamanyo estates, Peter Kamya borrowed a USD 6 million from Equity Bank – Kenya and its sister institution in Uganda.

The money was meant to finance the construction of a Hotel in Luzira, a Kampala suburb. He also wanted to freeze another loan he had taken out against his Shelter Afrique suites.

Among securities Mr Kamya’s company had offered were Simbamanyo Building and Afrique suites. Afrique Suites is a four-star hotel situated at Mutungo Hill in Kampala while Simbamanyo building is situated in the city center. No one however is talking about who bought Afrique Suites, Luwaluwa investments.

Simbamanyo building was auctioned to Dr Sudhir Ruparelia’s Meera Investments Limited – MIL while Afrique Suites was auctioned to Luwaluwa investments. Documents show that Luwaluwa Investments bought the property at $4,350,000 (more than Shs 16 billion) from the bank on the same day.

The little underscored fact is that Peter Kamya, the former proprietor of Simbamanyo Estates failed to pay his loans, ran out of options and Equity Bank through their lawyers, Sim Katende and Frederick Mpanga moved to auction the building legally – just as courts have ruled – because they were offered as securities and the bank had to recover the unpaid loan.

When Equity bank moved to recover its money, Kamya, through his Simbamanyo estates ran to court seeking the blockage of the execution of auctioning of both Afrique suites and Simbamanyo building.

However, High court judge Christopher Madrama asked him to pay 30% of the loan within 30 days as part of commitment that he was willing to pay back. The former Simbamanyo owner did not honor court until the mortgaged property was auctioned to Meera Investments Limited.

Meanwhile, Mr Kamya’s lawyers of Muwema and Co Advocates, advised him that he stil had a window of opportunity to repossess Simbamanyo. In August last year Kamya sued Equity Bank for breach of trust, unethical and illegal as well as predatory practices in auctioning the properties. However, the case has also been dismissed by the Court of Appeal.

More woes

With Simbamanyo gone, Peter Kamya’s woes continue. This website understands that he has two weeks to pay up or lose more properties due to accumulated loans.

Kamya owned several commercial properties in Kampala CBD and suburbs. However he has up to 7th September 2021 to pay up billions of shillings accumulated in bank loans or risk losing his entire estate and fortune, according to Kampala Bailiffs firm CL Risk Management Services.

The other properties being targeted for auctioning to recover bank’s money include multi-storied buildings, apartments and hotels in Nakawa Division particularized as Block 237 Mutungo; Plot 45 Block 237; Block 243 comprising of plots 2794, 957, 958, 1799 and 1800. Some of these are in the Luzira neighborhood.

It is not banks alone after Mr. Kamya. Among his creditors he has been playing include a group of Eritrean investors to whom he sold land that he never delivered despite receiving payment for the same. After taking their money, Mr Kamya now wants to turn against them by running court to stop them from recovering their money because they are non Ugandans.

Trading under Bahama Investments Ltd, the Eritreans also took Mr Kamya to the commercial division of the High Court to recover a two (2) acre piece of land n Munyonyo; Kyaddondo Block 255 Plots 126 and 213, for which they made partial payment.

This twist of events spans wayback in August 2015 when Kamya offered to sell the land to Bahamas at Shs5,090, 000,000 (Five billion and ninety million). He received the first installment of Shs1.3bn and was to get the balance of over Shs3.7bn after delivering the land titles to Bahamas’ bank, M/S Equity Bank in Kampala, according to news website Mulengera. Kamya however breached his contractual obligations and instead demanded the balance before surrendering the titles as agreed. Bahamas bosses rejected his demands arguing it wasn’t safe for them to act outside the sale agreement the two parties had signed at the start of the transaction.

It had been agreed that Kamya would originally transfer the land to lawyer Paul Muhimbura from whom the Eritrean firm would obtain a 99-year-leas. This was done to circumvent Constitutional provisions and the Land Act that prohibit non-Ugandan companies from outright ownership of land under the private Mailo tenure system.

For reasons better known to Kamya, refused to refund the money and turned around to accuse Eritreans of having tried to acquire the land illegally.

Eritreans filed a suit (No. 887 of 2016) in the High Court’s Commercial Division where Kamya had also filed his Defense (WSD) as required under Order 9 rule 1 of the Civil Procedure Rules. In a 4 page defense filed by his lawyers (Kahuma, Khalayi & Kaheeru Advocates), vowed not to refund the Shs1.3bn the Eritreans are demanding for on grounds the sale contract he willingly entered into was illegal and void since the Constitution prohibits non-Ugandan companies from purchasing Mailo land.

Kamya argued that court can’t give a remedy enforcing such prohibited contracts in favor of a non-Ugandan company. The Eritrean plaintiff company accused Kamya of acting fraudulently when he knowingly concealed information from them at the time of contracting that actually the same land was encumbered as he had previously surrendered it to satisfy security for costs requirements in a separate suit he was pursuing in Court of Appeal.

He is also accused of trying to dubiously resale the same land to Bank of Uganda months after purporting to sell the same to Bahamas, the plaintiff in the instant suit in the Commercial Court where it was filed in November 2016. Besides the Shs1.3bn, the plaintiff Eritrean Company is also asking for another Shs130m in interest arising from Kamya’s months’ long refusal to refund their Shs1.3bn.

Court records show that on 10th October 2016, Kamya shamelessly wrote to the Eritreans terminating the contract and declaring he wasn’t under any obligation to refund their Shs1.3bn on grounds this was a prohibited sale contract supposed to be illegal, null and void abnitio-and therefore incapable of enforcement in any court of law in Uganda. Court papers show Bahamas intended to erect modern apartments on the land.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com